Contents:

The advantages of using moving averages need to be weighed against the disadvantages. Moving averages are trend following, or lagging, indicators that will always be a step behind. After all, the trend is your friend and it is best to trade in the direction of the trend. Moving averages ensure that a trader is in line with the current trend. Even though the trend is your friend, securities spend a great deal of time in trading ranges, which render moving averages ineffective. Once in a trend, moving averages will keep you in, but also give late signals.

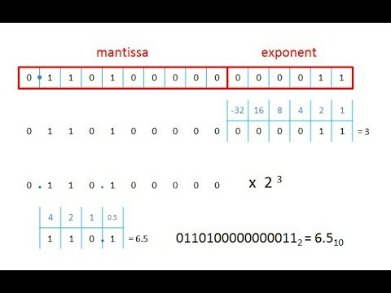

You need far more than 10 days of data to calculate a reasonably accurate 10-day EMA. In technical analysis, the moving average method is a simple but useful instrument. A stock’s support and resistance levels and trend direction can both be predicted using moving averages. Trend-following or trailing is because it uses previous prices as its basis.

What is Moving Average in Stock Trading? Definition & Examples – Finbold – Finance in Bold

What is Moving Average in Stock Trading? Definition & Examples.

Posted: Fri, 26 Aug 2022 07:00:00 GMT [source]

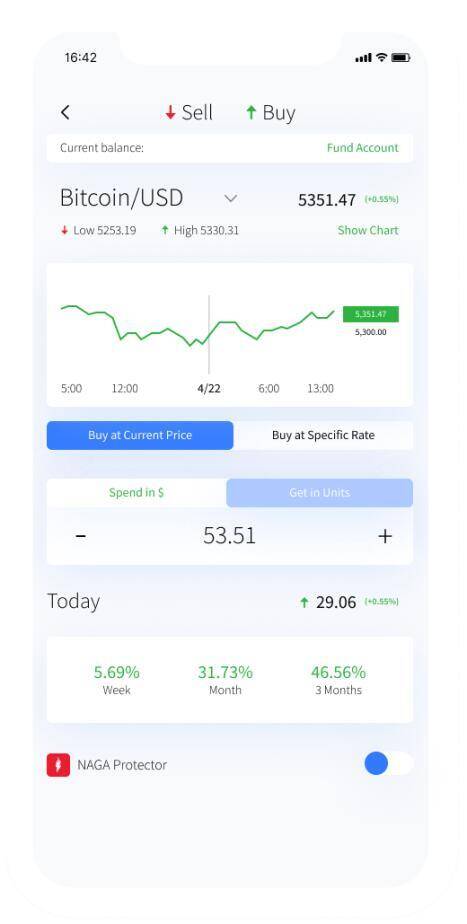

moving average method averages have the property to reduce the amount of variation present in the data. In the case of time series, this property is used to eliminate fluctuations, and the process is called smoothing of time series. Are plotted on stock charts to help smooth out volatility and point out that a stock may be trending. It may also help provide context for the price or volume movements during a given period as it makes it easier to spot divergences from an established price trend. A moving average helps cut down the amount of “noise” on a price chart.

Types of Moving Averages

The derivation and properties of the simple central moving average are given in full at Savitzky–Golay filter. Outside the world of finance, weighted running means have many forms and applications. Each weighting function or « kernel » has its own characteristics.

Moving averages will be used to determine the trend of a set of data in this section. ABC then purchases 250 additional green widgets on April 10 for $6 each (total purchase of $1,500). The moving average cost is now $5.25, which is calculated as a total cost of $5,250 divided by the 1,000 units still on hand. Under the moving average inventory method, the average cost of each inventory item in stock is re-calculated after every inventory purchase.

A moving average is a statistic that captures the average change in a data series over time. In finance, moving averages are often used by technical analysts to keep track of price trends for specific securities. An upward trend in a moving average might signify an upswing in the price or momentum of a security, while a downward trend would be seen as a sign of decline. Savvy demand planners that use moving averages for supply and operations planning will often use a weighted average for specific periods. To use a weighted average, you take each of the periods within our three period spread and use a percentage of that periods average.

The 50-day SMA fits somewhere between the 10- and 100-day moving averages when it comes to the lag factor. However, a moving average tends to lag because it’s based on past prices. Despite this, investors use moving averages to help smooth price action and filter out the noise. In using moving averages in estimating the trend, we shall have to decide as what should be the order of the moving averages. The order of the moving average should be equal to the length of the cycles in the time series. In case the order of the moving averages is given in the problem itself, then we shall use that order for computing the moving average.

Calculation of trend by moving Average method

The process involved in the management of e-resources has often overwhelmed the library personnel. In between these processes there is the cumbersome chore of going through the licensing agreements and keeping the records correct. All these processes are time consuming and involve a lot of work.

By default, both moving average overlays use 20 periods, but this parameter can be adjusted to meet your technical analysis needs. Use the offset field to shift the moving average the specified number of periods to the left or right . To calculate the moving average using data other than the Close, use the Calculated From field; this can be set to use the Open, High, Low, Volume, or other indicators that are on the chart. Moving averages can also be used to generate signals with simple price crossovers. A bullish signal is generated when prices move above the moving average.

How Does the the 200-Day Moving Average Affect Me? – Yahoo Finance

How Does the the 200-Day Moving Average Affect Me?.

Posted: Thu, 12 Jan 2023 08:00:00 GMT [source]

In business, it’s a common practice to calculate a moving average of sales for the last 3 months to determine the recent trend. By calculating the moving average, the impacts of random, short-term fluctuations on the price of a stock over a specified time frame are mitigated. When considering the role of a demand planner, the moving averages model is ideal for demand planning long in advance. As a demand planner or supply planner remember that because this model supports consistency, it will not be useful in identifying trends or seasonal factors in your forecast. That is why I recommend combining this method and the trend projections method in order to account for spikes and avoid stock-outs or overstocks.

Forecasting week-ahead hourly electricity prices in Belgium with statistical and machine learning methods

Therefore, you must calculate the moving average based on the given numbers. The graph at the right shows how the weights decrease, from highest weight for the most recent data, down to zero. It can be compared to the weights in the exponential moving average which follows. Similarly, upward momentum is confirmed with a bullish crossover, which occurs when a short-term moving average crosses above a longer-term moving average. Conversely, downward momentum is confirmed with a bearish crossover, which occurs when a short-term moving average crosses below a longer-term moving average. While it is impossible to predict the future movement of a specific stock, using technical analysis and research can help make better predictions.

- The next chart shows Emerson Electric with the 50-day EMA and 200-day EMA.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- An optional parameter can be added to specify which price field should be used in the calculations – “O” for the Open, “H” for the High, “L” for the Low, and “C” for the Close.

- This method is appropriate to remove, seasonal variations, cyclical fluctuations, and irregular variations.

This ensures that variations in the mean are aligned with the variations in the data rather than being shifted in time. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana.

What is the Moving Average Method in Time Series Analysis?

Using that information, you can construct a 5-year moving average, a 4-year moving average, and so on and so forth. Market analysts may employ a 50-day or 200-day moving average to assist them in analyzing market trends and predicting where the stock market will go in the near future. In technical analysis, the moving average is a simple but useful instrument. Hence, the method of moving averages is another technique for obtaining trends. Starting with a certain number of time periods, the average is calculated and then successive averages are calculated by dropping the first of the values and including the next one. Moving averages can be calculated using multiple time periods of differing lengths, depending on the trading intentions of the investor.

N is the number of periods for which the average requires to be calculated. Other choices for the order of the MA will usually result in trend-cycle estimates being contaminated by the seasonality in the data. There are no values for either the first two years or the last two years, because we do not have two observations on either side. Later we will use more sophisticated methods of trend-cycle estimation which do allow estimates near the endpoints.

A simple triple crossover system might involve 5-day, 10-day, and 20-day moving averages. The first day of the moving average simply covers the last five days. The second day of the moving average drops the first data point and adds the new data point . The third day of the moving average continues by dropping the first data point and adding the new data point .

What Are Moving Averages? How Do They Work? – MUO – MakeUseOf

What Are Moving Averages? How Do They Work?.

Posted: Wed, 09 Nov 2022 08:00:00 GMT [source]

A moving average method can be used to safeguard the price of a stock from the short-term volatility that is unavoidable in the financial markets. Exponential moving averages reduce the lag by applying more weight to recent prices. The weighting applied to the most recent price depends on the number of periods in the moving average. EMAs differ from simple moving averages in that a given day’s EMA calculation depends on the EMA calculations for all the days prior to that day.

Further, a bullish crossover indicates an upward momentum that occurs when a short-term moving average crosses above a long-term moving average. On the other hand, a bearish crossover indicates a downward momentum that occurs when a short-term moving average crosses below a long-term moving average. All these indicators are used in predicting the movement of securities in the future.

Include all the necessary steps to develop the forecast and why you would use the forecast you chose. Explain why knowing the type of variable matters when performing calculations or drawing graphs with data. Describe briefly the steps used to develop a forecasting system. Is the Cholesky decomposition the most appropriate method to identify structural shocks in VAR model? Explain the difference between a difference stationary and a trend stationary series.

This method tends to yield inventory valuations and cost of goods sold results that are in-between those derived under the first in, first out method and the last in, first out method. This averaging approach yields a safe and conservative financial result. The moving average model in time series can handle these fluctuations and smoothen them to give better forecast results for the near future. Statistically, the moving average is optimal for recovering the underlying trend of the time series when the fluctuations about the trend are normally distributed. It can be shown that if the fluctuations are instead assumed to be Laplace distributed, then the moving median is statistically optimal.

Ratio to moving average method

He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

In https://traderoom.info/ terms, moving-average levels can be interpreted as support in a falling market or resistance in a rising market. The moving average helps to level the price data over a specified period by creating a constantly updated average price. It is calculated by adding up all the data points during a specific period and dividing the sum by the number of time periods. The fluctuations automatically disappear if the period of moving averages and the period of cyclical fluctuations coincide. However, this method is useful for estimating trends in a period of transition when the mathematical lines or curves might not be sufficient. This method provides a basis for testing other types of trends, even though the data are not such as to justify its use otherwise.

Analysts or investors then use the information to determine the potential direction of the asset price. It is known as a lagging indicator because it trails the price action of the underlying asset to produce a signal or show the direction of a given trend. Fit a trend line by the method of four-yearly moving average to the following time series data.